NATIONAL INCOME ACCOUNTING

Table of Contents1. National Income Accounting

2. Concepts of National Income

3. Why GDP is the Most Acceptable Indicator Worldwide?

4. Depreciation

5. NDP & NNP

6. The concept of Market Price and Factor Cost

7. National Income (NI)

8. Transfer Payments

9. Personal Income (PI)

10. Disposable Personal Income (DPI)

11. Factors Affecting National Income

12. Comparing National Income Across Countries

13. Measurement of National Income

14. Recent Developments in GDP Measurement

15. Debates Around GDP and Other Indices

1. National Income Accounting

National Income Accounting or NIA refers to methods or techniques used to measure the economic activity in a national economy as a whole. As one can calculate income for a single person or an entity, the same can be done for a country also. In an economy, households buy goods and services from firms, and firms use their revenue from sales to pay wages to workers, rent to landowners, and profit to firm owners. GDP equals the total amount spent by households in the market for goods and services. It also equals the total wages, rent and profit paid by firms in the markets for the factors of production.

CIRCULAR FLOW OF ECONOMY IN AN OPEN ECONOMY WITH GOVERNMENT AND FOREIGN SECTOR

The diagram describes all the transactions between households and firms in a simple economy. It simplifies matters by assuming that all goods and services are bought by households and that households spend all of their income. Money continuously flows from households to firms and then back to households.

GDP measures this flow of money. It can be computed for an economy in one of the following ways:

- By adding up the total expenditure by households (Expenditure Method)

- By adding up the total income (wages, rent, profit) paid by firms (Income Method)

- By adding up the total value of all final goods and services produced in the economy (Output / Value Added Method)

Since all expenditure in the economy ends up as someone’s income, GDP is the same regardless of how we compute it.

Significance of National Income Accounting

- International Comparison: National Income Accounting measures growth rate and development of nations, which can be used to compare standard of living of different countries.

- Business Decisions: It reflects the relative contribution and potential of various sectors of the economy which guides the business class to plan for future production.

- Policy Formulation: It throws light on the distribution of income and resources in the economy, which helps government in proper allocation of resources to bring equality and development in nation.

- Policy Evaluation: The income accounting identifies specific economic achievements and failures which helps people of the nation in evaluating the policies of the government.

- Annual Budget: It shapes the budgetary policy of the Government, makes the borrowing and tax policy in order to neutralize the fluctuations of income and employment. The government takes to deficit or surplus budget to arrest depression or inflation in an economy.

- National statistics gives clear picture of how the national expenditure is divided into investment and consumption.

2. Concepts of National Income

Over a period of time four ways to calculate the income of a nation have been developed by the economists. These four ways to calculate the national income of a nation are GDP, GNP, NDP and NNP.

A. GDP or Gross Domestic Product

GDP or Gross domestic product refers to total market value of all the final goods and services produced in an economy in a given period of time. For India, this time period is from 1st April to 31st March. This means it measures the value of final goods and services produced within a geographic boundary regardless of the nationality of the individual or firm.

For instance, cars manufactured in India by Japanese company will be included in Indian GDP. Similarly, the Jaguar cars manufactured in UK by Tata will not be counted in India’s GDP.

It refers to only final output of such goods and services. The rule that only finished or final goods must be counted is necessary to avoid double or triple counting of raw materials, intermediate products, and final products. For example, the value of automobiles already includes the value of the steel, glass, rubber, and other components that have been used to make them.

To be precise, we define the following:

a) Final Output: Goods and Services purchased for final use.

b) Intermediate Goods/Factors of Production/Raw Materials: Products used as input in the production of some other product.

There are two ways to take into account double counting:

i. Calculate only the value of the final product.

ii. Calculate the value added at each stage of production, from the beginning of the process to the end. Specifically, it is derived by subtracting the value of the intermediate good from the value of the sale.

Real GDP and Nominal GDP

Nominal GDP refers to current year production of final goods and services valued at current year prices.

Real GDP on the other hand refers to the current year production of goods and services valued at base year prices. Such base year prices are constant prices.

Real GDP is a much better way to calculate the GDP because in a particular year GDP may be bloated up because of high rate of inflation in the economy. Real GDP, therefore, allows us to determine if production increased or decreased, regardless of changes in inflation and purchasing power of the currency.

To explain it better, consider an economy which produces only apples. In a particular year, say 2010, there were 100 apples produced in the economy and the cost of each apple was 1$. The nominal GDP of the economy in 2010 will be 100$ (multiplying 100 by 1$). After 5 years, the production of apples reduced to 50 apples in a year. However, the prices increased to 3$. Then nominal GDP for 2015 will be 150$ (multiplying 50 with 3$). It shows increase in GDP even though production got decreased.

Now consider year 2010 as base year. Then, the real GDP for the year 2010 will be 100$ and for the year 2015 will be 50$ (multiplying 50 with prices of 2010). The decline in real GDP is in proportion to decline in production in the economy. Thus, real GDP represents better picture of any economy than nominal GDP.

The concept of base year has been covered in greater detail in subsequent sections.

B. GNP or Gross National Product

The concepts of GNP or Gross National Product and GDP are closely related. As mentioned above, GDP reflects the goods and services produced within the boundaries of the country by both citizens and foreigners. GDP focuses on where the output is produced rather than who produced it. On the other hand, GNP is a measure of the value of output produced by the nationals of a country irrespective of the geographical boundaries. It refers to the output of Indian citizens both within India and in all other countries of the world.

To make it simpler, a few examples have been considered here. Microsoft is a US based firm. When it opens up a production utility in India, value of output from that utility is added to India’s GDP, but it is not added while calculating GNP of India. Similarly, when Indian companies such as Infosys or TCS produce services in the US, the value of those services are not added in the Indian GDP but they are utilized while calculating the Indian GNP. GDP is about where production takes place. GNP, on the other hand, is about who produces them.

GNP = GDP + Net Factor Income from Abroad. In case of an economy with great levels of inflows of FDI and very less outgoing FDI, the GDP would generally be more than the GNP. On the other hand, if in an economy, more of its nationals move abroad and generate economic activity when compared to foreigners who come in and perform any economic activity, its GNP would be larger than its GDP. In India’s case, GNP is lower than its GDP as net income from abroad has always been negative in India.

Even though GDP is a figure which is prominently used by economists across the world, some economists criticize it for not reflecting the true state of a nation’s economy. GDP takes into account the profits earned in a nation by overseas companies that are remitted back to foreign investors. If these remitted profits are very large compared with earnings from the nation’s overseas citizens and assets, the GNP will be significantly below GDP. The difference between GDP and GNP of a nation also reflects how much the outside world is dependent on its products and how much it depends on the world for the same.

Net Factor Income from Abroad

Net Factor Income from Abroad ( NFIA) is the difference between the aggregate amount that a country’s citizens and companies earn abroad, and the aggregate amount that foreign citizens and overseas companies earn in that country.

In short, Net Factor Income from Abroad = GNP – GDP.

Net foreign factor income in most of the countries is very small since factor payments earned by citizens and those paid to foreigners more or less offset each other.

3. Why GDP is the Most Acceptable Indicator Worldwide?

- GDP growth (as a measure of economic growth) is a major contributor to welfare and GDP tends to be correlated with several other measures of ‘development’, such as literacy and healthcare provision

- As currently defined, it has a clear methodology and is relatively easy to calculate.

- Since it is a monetary/mathematical/accounting calculation with an established methodology, it is objective (in contrast, such things as ‘happiness’ and ‘political freedom’ are subjective and difficult to measure).

- It is widely used and all GDP calculations are made using broadly the same methodology. This facilitates cross-country and over-time comparisons.

- Given its long history and standard methodology, it is reasonably well-understood by policymakers.

4. Depreciation

In the process of production, all machines and equipment used to produce other goods, are subject to some wear and tear. In economic parlance, this loss of capital which every economy has to suffer is called as Depreciation.

A part of capital goods produced in the economy must be devoted to replace this wear and tear. Otherwise, the productive capacity of a nation would be depleted. This replacement of the capital used is Capital Consumption Allowance.

In this scenario, the investment expenditure of the firms is made up of two parts. One part is to buy new capital goods and machinery for production. It is called Net Investment because the production capacity of the firms can be expanded.

Another part is spent on replacing the used-up capital goods or the maintenance of existing capital goods. The expenses incurred for this are called Depreciation Expenditure.

The total investment by firms comprising these two amounts is called Gross Investment.

Or, Net Investment = Gross Investment – Depreciation. The Net investment increases the production capacity and output of a nation if it is positive. This can easily be verified at the level of a single plant: the number of new machines installed in any given year must be greater than the machines that have been used up during that year.

The governments decide and announce the rates by which assets depreciate and a list is published, which is used by the different sections of the economy to determine the real levels of depreciations in different assets.

5. NDP or Net Domestic Product

Net Domestic Product (NDP) is the GDP calculated after adjusting the value of ‘depreciation’. This is, basically, net form of the GDP, i.e. GDP minus the total value of the ‘wear and tear’ (depreciation) that happened in the assets while goods and services were being produced.

NDP = GDP – Depreciation.

The NDP of an economy is always less than it’s GDP, because the Depreciation can never be reduced to zero and will always be positive.

6. NNP or Net National Product

The Net national product (NNP) is equal to gross national product (GNP) minus Depreciation.

NNP = GNP - Depreciation

The concept of NDP and NNP are not used to compare different economies because the method of calculating depreciation varies from nation to nation.

7. The concept of Market Price and Factor Cost

Market price refers to the actual transacted price of goods and services. It includes the indirect taxes which raise the prices and subsidies which lower the price.

Factor cost refers to cost of all factors of production used or consumed in producing goods and services. It includes rent for land, interest for capital, wages for labor and profit for entrepreneurship. It is the actual production cost at which the goods and services are produced by the firm. Thus, indirect taxes are excluded and subsidies by the government are included while calculating Factor Cost.

In other words, Factor Cost (FC) = Market Price – Net Indirect Taxes

Where, Net Indirect Taxes (NIT) = Indirect Taxes – Subsidies

Therefore, Factor Cost = Market Price - Indirect Taxes + Subsidies

Using this concept, the GDP at factor cost can be calculated by subtracting Net Indirect Tax from

GDP at Market Price.

Or, GDP at Factor Cost = GDP at Market Price – Net Indirect Tax

Or, GDP at Factor Cost = GDP at Market Price – Indirect Tax + Subsidies

Similarly, GNP at Factor Cost = GNP at Market Price – Net Indirect Tax

NDP at Factor Cost = NDP at Market Price – Net Indirect Tax

NNP at Factor Cost = NNP at Market Price – Net Indirect Tax

8. National Income (NI)

The National income is a measure of the sum of all factor incomes earned by the citizens of a country for their land, labor, capital, and entrepreneurial talent, whether within the country or abroad. It is equal to the Net National Product (NNP) at Factor Cost. It is obtained, as explained above, by deducting Net Indirect Tax from NNP at Market Price.

National Income at Factor Cost = NNP at Market Price – Indirect Taxes + SubsidiesThe reasons for choosing NNP at factor cost as National Income are:

- NNP shows the income earned by all citizens of country. This makes sense, since the earnings of foreigners should not be included in the India’s national income. Thus NNP is preferred over NDP.

- Factor Cost is used because Net Indirect Taxes like sales taxes, excise taxes are not the payments for factors of production.

- There is lack of uniformity in taxes among the countries.

- The goods are not printed with their prices in developing countries like India.

9. Transfer Payments

Transfer payments refer to payments made by the government to individuals for which there is no economic activity produced in return by these individuals. A few examples of transfer payments include old age pensions, scholarships etc.

10. Personal Income (PI)

Personal income includes all income which is received by all the individuals in a year. It also includes transfer payments such as LPG subsidy. The welfare payments are received by households, but they are not elements of national income because they are transfer payments. Similarly, in national income accounting, some income is attributed to individuals, which they do not actually receive such as undistributed profits, employee’s contribution for social security, corporate income taxes etc. These are part of national income but are not received by individuals. Therefore, they are to be deducted from national income to estimate the personal income. Thus Personal income is:

PI = NI + transfer payments — Corporate retained earnings, income taxes, social security taxes.

11. Disposable Personal Income (DPI)

Disposable personal income refers to the amount, which in actual is at the disposal of individuals to spend as they like. It is the amount which is left with the individuals after paying personal taxes such as income tax, property tax, professional tax etc.

Therefore, Disposable Personal Income = Personal Income—Personal Taxes.

DPI = PI — Personal Taxes.

This concept is very useful for studying and understanding the consumption and saving behavior of the individuals. It is the amount, which households can spend and save.

Disposable Income = Consumption + Savings

The important equations we have discussed so far are given below:

National Income = NNP at Factor CostNNP at Factor Cost = NNP at Market Price – Net Indirect TaxNDP at Factor Cost = NDP at Market Price – Net Indirect TaxNet Indirect Taxes (NIT) = Indirect Taxes – SubsidiesNNP = GNP – DepreciationNDP = GDP – DepreciationGNP = GDP + Net Factor Income from Abroad

12. Factors Affecting National Income

Several factors affect the national income of a country. Some of them have been listed below:

1. Factors of Production: Normally, the more efficient and richer the resources, higher will be the level of National Income or GNP.

2. Land: Resources like coal, iron and timber are essential for heavy industries so that they must be available and accessible. In other words, the geographical location of these natural resources affects the level of GNP.

3. Capital: Capital is generally determined by investment. Investment in turn depends on other factors like profitability, political stability etc.

4. Labour and Entrepreneur: The quality or productivity of human resources is more important than quantity. Manpower planning and education affect the productivity and production capacity of an economy.

5. Technology: This factor is more important for nations with fewer natural resources. The development in technology is affected by the level of invention and innovation in production.

6. Government: Government can help to provide a favorable business environment for investment. It provides law and order, regulations.

7. Political Stability: A stable economy and political system helps in appropriate allocation of resources. Wars, strikes and social unrests will discourage investment and business activities.

13. Comparing National Income Across Countries

To compare GDP between two countries having different currencies in use, GDP figures must first be converted into a common currency. The conversion of currency can be done using exchange rates. These exchange rates express the national currency's quotation in respect to foreign ones. For example, if exchange rate of dollar is 60 Rupees then the Indian GDP of 120 trillion Rupees would be worth 2 trillion Dollars.

Types of Exchange Rates

Economists distinguish between two exchange rates:

Nominal exchange rate and Real exchange rate.

Let’s discuss each in turn and see how they are related.

I) Nominal Exchange Rate is the relative price of the currencies of two countries. For example, if

the exchange rate between the U.S. dollar and the Indian Rupee is Rs. 60 per dollar, then you can exchange one dollar for 60 Rupees in world markets for foreign currency. When people refer to “the exchange rate’’ between two countries, they usually mean the nominal exchange rate. Nominal exchange rates are established on currency financial markets called "forex markets", which are similar to stock exchange markets.II) Real Exchange Rate is the relative price of the goods of two countries. That is, the real exchange rate tells us the rate at which we can trade the goods of one country for the goods of another. The real exchange rate is sometimes called the terms of trade.

Till now we have discussed the bilateral exchange rates which facilitate conversion of one’s currency into other. There is a concept of Effective Exchange Rate which describes the relative strength of a currency relative to basket of other currencies.

Thus, the Nominal Effective Exchange Rate (NEER) is the weighted average value of nominal exchange rate of the rupee against the currencies of major trading partners of India. On the other hand, the Real Effective Exchange Rate (REER) is the weighted average of Real Exchange Rates of Rupee against the currencies of major trading partners of India.

The weights are determined by the importance that a home country places on all other currencies traded within the pool, as measured by the balance of trade. Unlike NER and RER, NEER and REER are not determined for each foreign currency separately. Rather, each is a single number that expresses what is happening to the value of the domestic currency against a whole basket of currencies. It gives some reference or benchmark about how the currency is performing in relation to the rest of the world as a whole, rather than just individual countries. Even though Indian GDP calculated in rupees can be converted to dollars using market determined exchange rate but such an exercise has its own limitations. Such a market determined exchange rate only takes into account exports and imports and neglects non-traded GDP, which produced and consumed domestically. In such a situation, the concept of Purchasing Power Parity (PPP) is used.

The Purchasing Power Parity tells us how much of a basket of internationally traded goods and services can be bought with Indian rupee in India vis-à-vis how much of the same basket can be bought in the US with the help of a dollar. Therefore, whereas the market determined exchange rate might be Rs 60 for a US dollar, the PPP exchange rate may show this parity at Rs 30 for a US dollar. This ultimately results in a greater GDP at PPP rates when compared to GDP at market rates for India.

14. Measurement of National Income

In India, GDP is estimated by Central Statistical Office (CSO).

There are three different ways of estimating the national income of a country, these three methods are:

- Value Added Method (or the Product Method)

- Income Method

- Expenditure Method

Which method is to be employed depends on the availability of data and purpose.

1. Value Added Method

Under the value added or production method, the GDP is calculated at market prices, which is the total value of outputs produced at different stages of production. It needs to be mentioned that caution should be taken to take Final Goods and not Intermediate Goods, as it will result in Double Counting.

Some of the goods and services included in production are:

- Goods and services sold in the market.

- Goods and services not sold but supplied free of cost.

- Services provided by the agents

For example, in a Cycle Manufacturing Unit, computing the total value of cycles produced in a year, the final value of the cycle (Multiplied by total no of units produced) which is ready to be marketed for sale will be taken, not the cost of intermediate goods which are used in the process of manufacture, as it will result in double counting. Suppose the market price of a cycle is Rs. 2000 which includes, say, profit margin of Rs. 200 besides the cost of manufacturing of Rs. 1800. This 1800 includes all costs including components and parts etc. (these are intermediate goods which are used in the process of production.) If the costs of parts etc. are also taken while computing final value of total units produced, it will give inflated figure and hence result in double counting error. Similarly, at macro level, while computing the national Income under Value Added Method the value of final goods and services should be taken up to avoid the double counting error as the cost of Intermediate Goods are already counted in the final value of the product.

Some of the goods and services not included in production are:

- Second hand items and purchase and sale of the same. Sale and purchase of used cars, for example, are not a part of GDP calculation as no new production takes place in the economy.

- Production due to illegal activities.

- Non-economic goods such as air and water.

- Transfer Payments such as scholarships, pensions etc. are excluded as there is income received, but no good or service is produced in return.

2. Income Method

This approach focuses on aggregating the payments made by firms to households, called factor payments. This gives the National Income, defined as total income earned by citizens and businesses of a country.

There are four types of factors of production and four types of factor incomes accordingly i.e. Land, Labour, Capital and Organization as Factors of Production and Rent, Wages, Interest and Profit as Factor Incomes correspondingly.

We need to add indirect taxes, less subsidies and add depreciation to get GDP.

GDP = Wages+ Interest + Rent +Profit + Dividend + Indirect Taxes-Subsidies+ Depreciation

The term Profit can be further sub-divided into: profit tax; dividend to all those shareholders; and retained profit (or retained earnings.

Such an approach is adopted in India to calculate the contribution of services sector to the economy.

Any income corresponding to which there is no flow of goods and services or value added, it should not be included in calculation by Income method.

3. Expenditure Method

The expenditure method measures the final expenditure on GDP. Amount of Expenditure refers to all spending on currently-produced final goods and services only in an economy. In an economy, there are three main agencies, which buy goods and services. These are: Households, Firms and the Government.

This final expenditure is made up of the sum of 4 expenditure items, namely:

a) Consumption (C): Personal Consumption made by households, the payment of which is paid by households directly to the firms which produced the goods and services desired by the households.

b) Investment Expenditure (I): Investment is an addition to capital stock of an economy in a given time period. This includes investments by firms as well as governments sectors.

c) Government Expenditure (G): This category includes the value of goods and service purchased by Government. Government expenditure on pension schemes, scholarships, unemployment allowances etc. are not included in this as all of them come under transfer payments.

d) Net Exports (X-IM): Expenditure on foreign made products (Imports) are expenditure that escapes the system, and must be subtracted from total expenditures. In turn, goods produced by domestic firms which are demanded by foreign economies involve expenditure by other economies on our production (Exports), and are included in total expenditure. The combination of the two gives us Net Exports.

GDP= C+I+G+X-IM

15. Application of Various Methods

Each approach gives a different perspective on the economy. However, the fundamental principle underlying national income accounting is that, all three approaches give identical measurements of the amount of current economic activity.

We can illustrate why these three approaches are equivalent with the help of an example.

Imagine an economy with only two businesses, called Khanna Fruits and Sharma Juices. Khanna Fruits owns and operates orange groves. It sells some of its oranges directly to the public. Rest of these oranges are sold to Sharma Juices which is involved in the production and sale of orange juice. The following table shows the transactions of each business during a year.

Product Method

- Khanna Fruits produces output worth Rs. 35,000 and Sharma Juices produces output worth Rs. 40, 000. However, measuring overall economic activity by simply adding Rs. 35,000 and Rs. 40,000 would “double count” the Rs. 25,000 of oranges that Sharma Juices purchased from Khanna Fruits and processed into juice. To avoid this double counting, we sum value added rather than output: Because Sharma Juices processed oranges worth Rs. 25,000 into a product worth Rs. 40,000, Sharma Juices value added is Rs. 15,000 (40,000 – 25,000). Khanna Fruits doesn’t use any inputs purchased from other businesses, so its value added equals its revenue of Rs. 35,000. Thus total value added in the economy is Rs. 35,000 + Rs. 15,000 = Rs. 50,000

Income Approach

- As seen before, the (before-tax) profits of Khanna Fruits equal its revenues of 35,000 minus its wage costs of Rs. 15,000. The profits of Sharma Juices equal its revenues of Rs. 40,000 minus the Rs. 25,000 the company paid to buy oranges and the Rs. 10,000 in wages to its employees. Adding the Rs. 20,000 profit of Khanna Fruits, the Rs. 5,000 profit of Sharma Juices, and the Rs. 25,000 in wage income received by the employees of the two companies, we get a total of Rs. 50,000, the same amount determined by the product approach

Expenditure Approach

- In this example, households are ultimate users of oranges. Sharma Juices is not an ultimate user of oranges because it sells the oranges (in processed, liquid form) to households. Thus ultimate users purchase Rs. 10,000 of oranges from Khanna Fruits and Rs. 40,000 of orange juice from Sharma Juices for a total of Rs. 50,000, the same amount computed in both the product and income approaches. Output or Value added method is primarily used in the registered manufacturing units and primary sector in India. Income method is used in services sector. Whereas, the expenditure method is adopted to calculate the contribution of Real Estate Sector. The product method is the principal method used in underdeveloped economies, whereas income method is generally used in developed economics for the estimation of national income.

Base Year, GDP Deflator

GDP Deflator: It is a tool to measure the inflation comprehensively. It represents the ratio of GDP at current prices to GDP at constant prices. GDP deflator is published on a quarterly basis since 1996 with a lag of two months. It is because of this very reason that economists prefer the use of WPI or CPI for deflating nominal price estimates to derive real price estimates.

Essentially GDP deflator = (Nominal GDP/Real GDP) * 100.

Unlike the WPI and the CPI, GDP deflator is not based on a fixed basket of goods and services, it covers the whole economy. One of the other advantages of GDP deflator is that changes in consumption patterns or the introduction of new goods and services are automatically reflected in the deflator, such a feature is missing in WPI/CPI.

Base Year: To make the calculation of GNP/GDP easier, economists use a price index to find the real GNP/GDP. A Price index is a number showing the changes in the overall level of prices. It shows a change in the general price level of an economy. Base year is the year used as the beginning or the reference year for constructing an index, and which is usually assigned an arbitrary value of 100.

The Indian Government has changed the base year for calculating national accounts to 2011-12 from 2004-05. The basis for selection of the base year are:

- Stability of macroeconomic parameters. It has to be a normal year without large fluctuations in production, trade and prices of goods and services.

- Data availability: Data available for the year should be reliable.

- Comparability- so that same parameters should be in use in both the years. Therefore, it should be a recent year and not go long back into history.

Difficulty of Measurement (With Special Reference to India)

Economists face a number of problems while calculating the National Income some of them are:

a) Non-Monetization of transactions: When National Income is calculated it is generally assumed that any products or services would be exchanged for money. But in India especially in rural areas, a large number of economic transactions occur in the form of barter. Such activities are difficult to account for in the GDP estimates therefore resulting in lower levels of GDP than actual.

b) Unreported Illegal Income: A major part of Indian Economy operates as hidden or parallel economy and the income generated in this goes unreported. As per a study, black economy accounts for about 40% of total income generated in the country. This poses a great problem to calculate accurate GDP estimates.

c) Non-availability of data about households, small producers etc.: A large number of producers carry out production at a family level or run household enterprises. Data about these enterprises is very difficult to find. NIA does not include care economy such domestic work and housekeeping. Even the valuable work done by housewives in India is not accounted as a part of GDP estimates.

d) Absence of data on growing service sector: In India, service sector has witnessed an exponential growth rate. However, value addition in several parts of service sector industry are not based on accurate reporting and hence underestimated in national income measures.

Recent Developments in GDP Measurement

- The growth rate will now be measured by GDP at constant market prices, which will henceforth be referred to as 'GDP'. This is the international practice. Earlier, growth was measured in terms of growth rate in GDP at factor cost at constant prices.

- The sector-wise estimates of gross value added (GVA) will now be given at basic prices instead of factor cost.

- Use of MCA21 database which is the annual accounts of companies filed with Ministry of Corporate Affairs. It will expand the coverage of corporate sector both in manufacturing and services. Also, the database for manufacturing companies will help account for activities other than manufacturing undertaken by these companies

- Comprehensive coverage of the financial sector by inclusion of information from the accounts of stock brokers, stock exchanges, asset management companies, mutual funds and pension funds, and the regulatory bodies – SEBI, PFRDA and IRDA.

- Improved coverage of activities of local bodies and autonomous institutions, covering around 60 per cent of the grants/transfers provided to these institutions.

Gross Value Added

Gross value added (GVA) is defined as the value of output less the value of intermediate consumption. Value added represents the contribution of labour and capital to the production process. The GVA at basic prices will include production taxes and exclude production subsidies available on the commodity.

On the other hand, GVA at factor cost includes no taxes and excludes no subsidies and GDP at market prices include both production and product taxes and excludes both production and product subsidies. When the value of taxes on products (less subsidies on products) is added, the sum of value added for all resident units gives the value of gross domestic product (GDP).

The above concept is summarized in the following equations:

GVA at basic prices = CE + OS/MI + CFC + production taxes less production subsidies

GVA at factor cost = GVA at basic prices - production taxes less production subsidies

GDP = ∑ GVA at basic prices + product taxes - product subsidies

The terms used in above equations are discussed below.

CE: compensation of employees. It refers to the total gross (pre-tax) wages paid by employers to employees for work done

OS: operating surplus. It represents the excess amount of money generated by enterprise after paying labour input costs. It is the capital available to repay their creditors, to pay taxes and eventually to finance all or part of their investment.

MI: mixed income. This is similar to the concept of operating surplus but applied to unincorporated enterprises such as small family businesses like farms and retail shops or self-employed taxi drivers

CFC: consumption of fixed capital. It represents the amount of fixed assets used up, during the period under consideration. This concept is different from depreciation as unlike depreciation, it is not measured at ‘historic cost’ (original price), but at current market value.

Production taxes or subsidies: These are paid or received with relation to production and are independent of the volume of actual production. Some examples of production taxes are land revenues, stamps and tax on profession. Some production subsidies are subsidies to Railways, input subsidies to farmers.

Product taxes or subsidies: They are paid or received on per unit of product. Some examples of product taxes are excise tax, sales tax, service tax and import and export duties. Product subsidies include food, petroleum and fertilizer subsidies

Debates Around GDP and Other Indices

Traditionally, economic growth is treated as a measure of improvement in quality of lives of the citizens of a country. Economic growth per se is calculated in the form of growth in GDP year over year. However, the achievement of high growth – even high levels of sustainable growth – must ultimately be judged in terms of the impact of that economic growth on the lives and freedoms of the people. It must be noted that the economic growth in several countries has not transformed into better quality of lives for the people.

Let us take the example of India. India has witnessed rapid economic growth in last two decades. Over this period of rapid growth, while some people, particularly among the privileged classes, have done very well, many more continue to lead unnecessarily deprived and precarious lives. It is not that their living conditions have not improved at all, but the pace of improvement has been very slow for the bulk of the people, and for some there has been remarkably little change. While India has climbed rapidly up the ladder of economic growth rates, it has fallen relatively behind in the scale of social indicators of living standards, even compared with many countries India has been overtaking in terms of economic growth.

For example, over the last two decades India has expanded its lead over Bangladesh in terms of average income (it is now about twice as rich in income per capita as Bangladesh), and yet in terms of many typical indicators of living standards (other than income per head), Bangladesh not only does better than India, it has a considerable lead over it (just as India had, two decades ago, a substantial lead over Bangladesh in the same indicators).

Another typical example is that of the Gulf Countries, which have witnessed rapid economic growth but they have done rather poorly on development indicators.

Therefore, several economists today define economic development differently from what the world meant by economic growth. For economists, development indicates the quality of life in the economy which might be seen in accordance with the availability of so many variables such as:

- The level of nutrition.

- The expansion and the reach of healthcare facilities—hospitals, medicines, safe drinking water, vaccination, sanitation, etc.

- Education levels

From the above discussion it is clear that today, economists believe that higher economic growth may not necessarily transform into higher economic development. But at the same time economic growth and development go hand in hand and one cannot survive without the other.

When we use the term growth we mean numerical increase in some parameters and when we use the term development we mean numerical as well as qualitative progress. If economic growth is properly used for development, it results in accelerating the growth and ultimately in greater population coming under the arena of development. Similarly, high growth with low development and ill-cared development finally results into fall in growth. Thus, there is a circular relationship between growth and development.

Other Arguments Against GDP as a Parameter to Judge Progress

- Gender disparities not indicated: For this a GII or Gender Inequality Index has been devised in recent years.

- Does not measure sustainability of growth: Growth in a country may be also at the cost of hefty exploitation of natural resources.

- Condition of poor is not indicated: As an example, even though Indian economy grew at a rate of over 7-8% in last decade the food inflation was at the highest levels adversely affecting the poorest strata of the society.

- Economic inequality not revealed by GDP: GDP does not reveal the economic inequality, which is created as a side effect of economic growth. Inequality in earnings has doubled in India over the last two decades which were incidentally the years of highest GDP growth also.

- Other intangibles not measured: Does not value intangibles like leisure, quality of life etc. since quality of life is measured by many other intangibles except the materialistic things provided by economic growth.

For the reasons mentioned above, several economists have tried to create replacements for GDP which try to address the above criticisms regarding GDP. Some of these indices include HDI, HPI (human poverty Index), GNH (Gross National Happiness Index), Green GDP etc.

Other Indices to Measure Development

1. HDI or Human Development Index

United Nations Development Programme (UNDP) published its first Human Development Report (HDR) in 1990. The report had a human development index (HDI) which was the first attempt to define and measure the levels of development. The index focuses on longevity, knowledge and decent living standards.

Standard of living: to be indicated by the real per capita income adjusted for the differing purchasing power parity (PPP).

Knowledge: to be measured by indicators related to the level of education:

- educational attainment among the adults (given 2/3rd weightage).

- school enrollment (given 1/3rd weightage).

Longevity: Life expectancy to be calculated at the time of birth.

The HDI is the geometric mean of normalized indices for each of the above three dimensions. Initially reported for 14 countries, the UN’s 2016 report presented HDI results for 188 countries. India’s current score is up from 0.428 in 1990, i.e. an increase of 46% between 1990 and 2016.

According to the Human Development Report 2021-22, India’s rank on the Human Development Index (HDI) has slipped from 130 in 2020 to 132 in 2022, in line with a global fall in HDI scores in the wake of the Covid-19 pandemic.

It's published by the Human Development Report Office for the United Nations Development Programme (UNDP).

Goal: The goal is to contribute toward the expansion of opportunities, choice and freedom.

Theme: The theme for Human Development Report 2021-22 is Uncertain Times, Unsettled Lives: Shaping our Future in a World in Transformation

2. Gender Inequality Index (GII)

- The GII is an inequality index. It shows the loss in potential human development due to disparity between female and male achievements in two dimensions, empowerment and economic status, and reflects a country’s position relative to normative ideals for the key dimension of women’s health. Overall, the GII reflects how women are disadvantaged in these dimensions.

- There is no country with perfect gender equality – hence all countries suffer some loss in achievements in key aspects of human development when gender inequality is taken into account. The GII ranges between 0 and 1 and higher GII values indicate higher levels of inequalities.

3. Gender Development Index (GDI)

- The GDI measures differences between male and female achievements in three basic dimensions of human development:

- Health, measured by female and male life expectancy at birth;

- Education, measured by female and male expected years of schooling for children and female and male mean years of schooling for adults ages 25 and older; and

- Equitable command over economic resources, measured by female and male estimated earned income.

4. Multidimensional Poverty Index (MPI)

- The Multidimensional Poverty Index (MPI) identifies multiple deprivations at the household and individual level in health, education and standard of living. The MPI offers a valuable complement to income-based poverty measures.

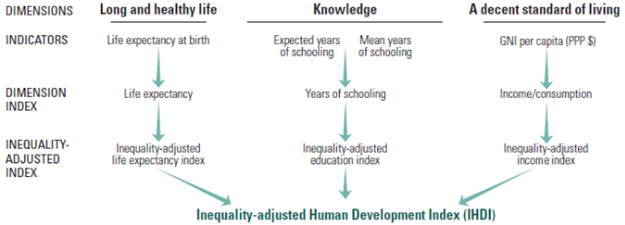

5. Inequality-Adjusted Human Development Index (IHDI)

- The IHDI takes into account not only the average achievements of a country on health, education and income, but also how those achievements are distributed among its population.

6. Green GDP

- Green GDP is an index of economic growth with the environmental consequences of that growth factored in. From the final value of goods and services produced, the cost of ecological degradation is deducted to arrive at Green GDP.

- Green GDP calculations have been developed for countries as diverse as Australia, Canada, China, Costa Rica, Indonesia, Mexico, Papua New Guinea, and the US, although none of these efforts have resulted in regular reporting of the results.

- In 2009, the Government of India had announced its intention to unveil “green GDP” figures that account for the environmental costs of depletion and degradation of natural resources into the country’s economic growth figures. Subsequently, the Ministry of Statistics and Programme Implementation set up an expert group in 2011 led by Partha Dasgupta to work out a framework for green national accounts in India. However, the process is yet to be completed.

7. Gross National Happiness

With many of the world's countries about as unhappy as they can get because of their dwindling GDP figures, the tiny nation of Bhutan has gone in the opposite direction. Officials in Bhutan came up with a different indicator, called gross national happiness (GNH). The country's beloved former king, Jigme Singye Wangchuck, envisaged the concept of gross national happiness since 1972, and the country adopted it as a formal economic indicator in 2008. Beginning in November 2008, all the economic factors started measuring gross domestic product analyzed for their impact on Bhutan's residents' happiness. The factors of production are still there such as unemployment, agriculture, retail sales but GNH represents a paradigm shift in what's most valued by Bhutanese society compared to the rest of the world. In short, happiness matters, not money.

Following parameters are used in the GNH:

- Higher real per capita income.

- Good Governance.

- Environmental Protection.

- Cultural Promotion

8. Human Poverty Index or HPI

- HPI is an index, which focuses solely on amount of poverty in a country. This index has been developed by United Nations. For HPI, deprivations in longevity are measured by the probability at birth of not surviving to age 40; deprivations in knowledge are measured by the percentage of adults who are illiterate; deprivations in a decent standard of living are measured by two variables: the percentage of people not having sustainable access to an improved water source and the percentage of children below the age of five who are underweight.

- HPI focuses attention on the most deprived people and deprivations in basic human capabilities in a country, not on average national achievement. The human poverty indices focus directly on

the number of people living in deprivation presenting a very different picture from average national achievement. It also moves the focus of poverty debates away from concern about income poverty alone

9. Genuine Progress Indicator

- While GDP is a measure of current income, GPI is designed to measure the sustainability of that income. GPI uses the same personal consumption data as GDP but make deductions to account for income inequality and costs of crime, environmental degradation, and loss of leisure and additions to account for the services from consumer durables and public infrastructure as well as the benefits of volunteering and housework. By differentiating between economic activity that diminishes both natural and social capital and activity that enhances such capital, the GPI and its variants are designed to measure sustainable economic welfare rather than economic activity alone. Proponents of the GPI see it as a better measure of the sustainability of an economy when compared to the GDP measure. Since 1995 the GPI indicator has grown in stature and is used in Canada and the United States.

---> Next Article will be updated soon..

![ARTICLE 18: ABOLITION OF TITLES - CONSTITUTION OF INDIA [POLITY NOTES]](https://dzcots5lswgyq.cloudfront.net/uploads/1680959574A.jpg)

.jpg)

.jpg)

.png)